Business Interruption Insurance Explained

Business Interruption Insurance is a crucial aspect of risk management for businesses across various industries. This type of insurance provides coverage for income loss and additional expenses incurred when a business is forced to temporarily shut down or reduce its operations due to covered events. In this article, we will delve into the intricacies of Business Interruption Insurance, exploring its components, the claims process, legal considerations, and its evolving landscape.

Introduction to Business Interruption Insurance

Business Interruption Insurance, often referred to as Business Income Insurance, is designed to protect businesses from financial losses resulting from disruptions to their normal operations. Whether it’s a natural disaster, a fire, or a public health emergency like the COVID-19 pandemic, this insurance aims to help businesses recover from the economic impact of such events.

Key Components of Business Interruption Insurance

Understanding the key components of Business Interruption Insurance is vital for businesses to make informed decisions. Coverage types may vary, including loss of income, operating expenses, and extra expenses incurred during the restoration period. Factors influencing coverage often include the type of business, location, and the extent of the interruption.

Events Covered by Business Interruption Insurance

Business Interruption Insurance typically covers a range of events, from natural disasters like earthquakes and floods to man-made disasters such as fires and explosions. In recent times, public health emergencies, as witnessed during the COVID-19 pandemic, have also become factors triggering coverage.

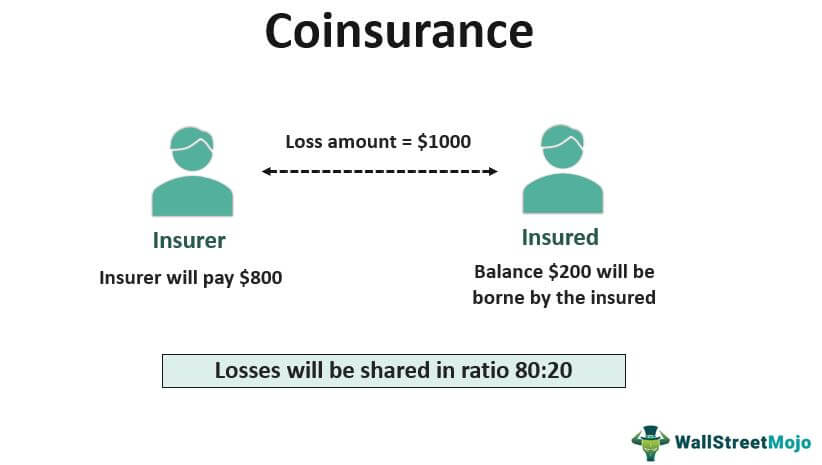

Calculating Business Interruption Losses

Determining the financial impact of an interruption is a critical aspect of Business Interruption Insurance. The formula for calculating losses involves assessing the profits the business would have earned if the interruption had not occurred. Real-world case studies can provide practical insights into this calculation methodology.

Common Misconceptions About Business Interruption Insurance

Despite its significance, there are common misconceptions about Business Interruption Insurance. Some businesses may have a limited understanding of what is covered, emphasizing the importance of tailoring policies to specific needs rather than relying on generic coverage.

Selecting the Right Business Interruption Insurance for Your Business

Choosing the right coverage requires a thorough assessment of a business’s needs. Collaborating with insurance professionals who understand the industry and its risks is crucial. Tailored policies can make a significant difference in the effectiveness of the coverage.

Claims Process in Business Interruption Insurance

In the unfortunate event of an interruption, businesses need to navigate the claims process efficiently. Documenting losses comprehensively and maintaining transparent communication with insurers are key steps to ensure a smooth claims process.

Impact of COVID-19 on Business Interruption Insurance

The global pandemic has reshaped the landscape of Business Interruption Insurance. Examining the lessons learned and changes in the industry can provide valuable insights into how businesses can adapt to unforeseen challenges.

Case Studies: Real-World Examples of Business Interruption and Insurance Claims

Exploring real-world examples of businesses successfully navigating interruptions and insurance claims, as well as challenges faced, offers practical lessons for others in similar situations.

Legal Aspects and Challenges in Business Interruption Insurance

Legal considerations play a significant role in Business Interruption Insurance. Examining litigation trends and understanding the legal landscape can help businesses prepare for potential challenges.

Technology and Business Interruption Insurance

Technology is increasingly playing a role in assessing and mitigating risks associated with business interruptions. From advanced risk assessment tools to streamlined claims processing, technology is transforming how businesses and insurers approach Business Interruption Insurance.

Future Trends in Business Interruption Insurance

As risks continue to evolve, so does the landscape of Business Interruption Insurance. Exploring future trends, including emerging risks and innovations in coverage, can help businesses stay ahead of the curve.

Tips for Businesses to Mitigate Business Interruption Risks

Proactive measures, such as implementing robust business continuity plans and investing in risk mitigation strategies, can significantly reduce the impact of business interruptions.

Comparing Business Interruption Insurance Across Industries

Different industries face unique risks, and their insurance needs may vary. Comparing how businesses in specific sectors approach Business Interruption Insurance can provide insights into best practices for each industry.

Conclusion

In conclusion, Business Interruption Insurance is a critical tool for businesses to safeguard their financial stability in the face of unforeseen disruptions. By understanding its components, navigating the claims process effectively, and staying abreast of industry trends, businesses can proactively manage risks and ensure a smoother recovery.

Get Access Now: https://bit.ly/J_Umma

FAQs About Business Interruption Insurance

- Is Business Interruption Insurance only for large businesses?

- No, businesses of all sizes can benefit from Business Interruption Insurance. The coverage can be tailored to meet the specific needs of small, medium, and large enterprises.

- How long does it take to process a Business Interruption Insurance claim?

- The processing time can vary based on the complexity of the claim and the documentation provided. Efficient communication with insurers can expedite the process.

- Can Business Interruption Insurance cover losses due to a cyber-attack?

- It depends on the policy. Some Business Interruption Insurance policies may include coverage for losses resulting from cyber incidents, while others may require additional cybersecurity insurance.

- Are there limitations to the events covered by Business Interruption Insurance?

- Yes, policies may have specific exclusions. It’s essential for businesses to carefully review and understand the terms of their coverage.

- How often should a business review its Business Interruption Insurance policy?

- Businesses should review their policies annually or whenever there are significant changes to the business, such as expansion, relocation, or changes in operations.

This comprehensive guide aims to demystify Business Interruption Insurance, providing businesses with the knowledge they need to navigate the complexities of coverage and ensure financial resilience in the face of unforeseen events.